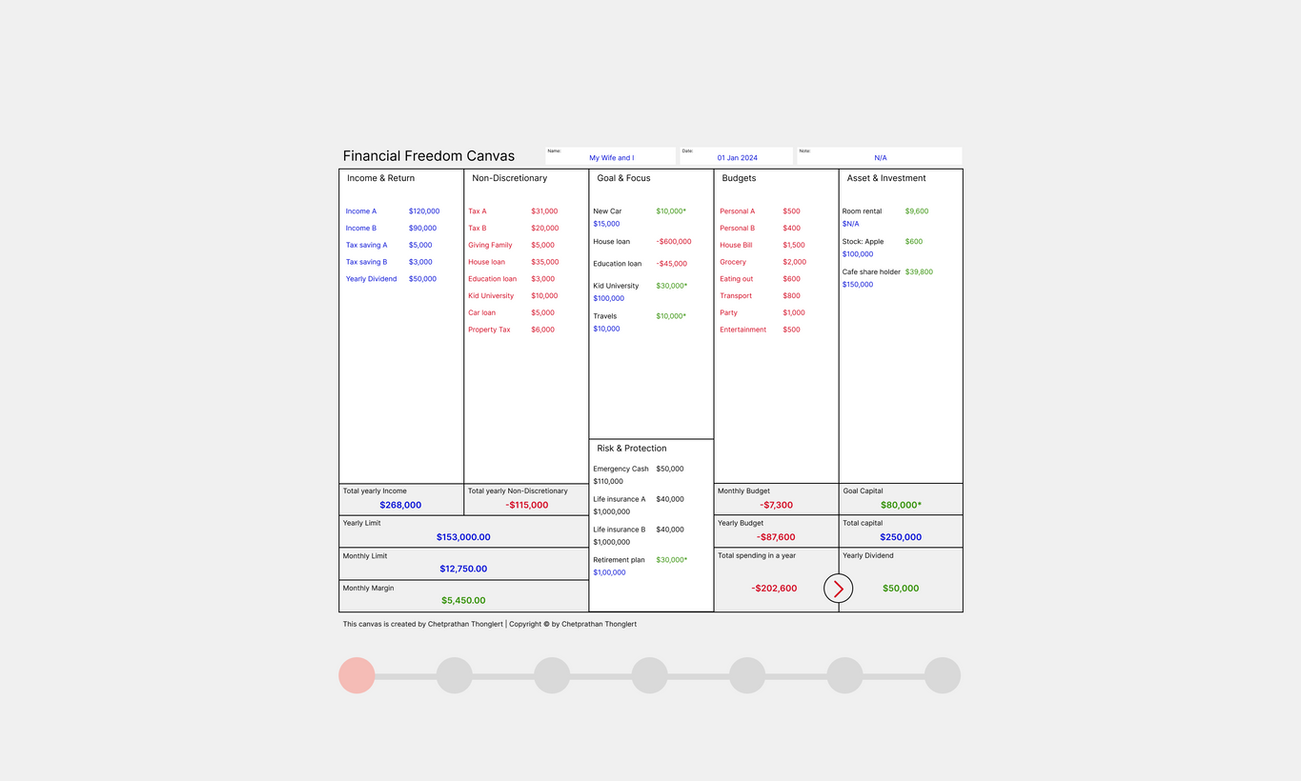

Financial Freedom Canvas

Introducing the Financial Freedom Canvas, a self-management tool that can assist you in planning, designing, challenging, and achieving your financial objectives. This tool allows you to monitor your wealth and prioritize each goal that you aspire to accomplish. By gaining a better understanding of your finances, you can focus on accelerating your wealth to meet your desired goals.

Goals

Establishing long-term, mid-term, and short-term goals. Setting goals is effective for providing direction and motivation. Breaking down larger goals into smaller ones helps maintain focus and progress towards desired outcomes.

Prioritize

Managing our finances can be challenging but prioritizing our spending is definitely a key factor. By seeing the big picture of our money, we can make informed decisions and ensure that we are using our resources in the most effective way possible.

Accelerate

Gain a better understanding of your finances with our top view feature. See where your money is coming from and how much you're spending. By minimizing expenses and allocating your investments wisely, you can reach your financial goals faster.

How does this canvas work?

The Financial Freedom Canvas is a powerful tool that can help you gain a clear understanding of your wealth. Divided into six important parts, it allows you to focus on each category and make adjustments throughout the year. By balancing your spending, investing, and wealth protection, you can achieve financial freedom by earn more yearly dividends than your total yearly spending. Start using the Financial Canvas today and take control of your financial future.

Let's Start

Spending Record

1st Step

(Budgets & Non-Discretionary)

Managing your finances can be challenging, but it all starts with a simple equation: spend less than you earn. If have a big financial goal, consider finding ways to increase your income or reduce your expenses. To get started, it's important to track your spending and identify areas where you can cut back. You might be surprised by how much you can save!

Find how much you earn?

2nd Step

(Income & Return)

Calculating your annual income is a crucial step towards managing your finances effectively. By having a clear idea of your earnings for the year, you can plan your expenses and investments accordingly. It also helps you determine if you're on track to achieving financial freedom, and if not you can take steps make it happen. This is especially important for younger individuals who can start early and let their money work for them to generate passive income.

Spending the saving

3rd Step

(Goals & Risk & Investment)

Spending your savings wisely is crucial for securing your financial future. By planning ahead and limiting risks, you can open yourself up to new opportunities and unexpected windfalls. With a stable financial plan in place, you'll be better equipped to make the most of your life's opportunities.

Slide through our pictures to see the change

Stages in the game

Changes You Will Love

01

Living Debt

If you are currently facing debt due to living expenses, it can be viewed as an opportunity to start anew By altering your lifestyle, increasing your income, reducing your living costs, and eliminating your debt, you can set yourself on a path towards financial stability. Prioritizing debt elimination as a goal and maintaining good health will be crucial in achieving success.

03

Spent your Saving

Awesome! I'm thrilled to hear that you're enjoying the process of growing your wealth. Setting multiple goals, both short-term and long-term is a fantastic way to achieve small wins along the way. Don't forget to celebrate each success, as it can provide a sense of accomplishment and motivation to reach the next goal. Keep up the fantastic work!

02

Month to Month

One effective way to address the issue of not any savings is to track your monthly expenses and identify which categories are consuming the most of your funds. Once you have identified these categories, you can set a budget and adjust your lifestyle accordingly to ensure that you are able to save money. This approach can help you achieve your financial goals and build a more future.

04

Passive Income

Having a passive income can definitely help you achieve financial freedom. Re-investing the money and keeping your lifestyle within the same budget is a smart way to accelerate your success. It's also to find work that you love and enjoy doing. Giving back and setting a budget for it can bring even more happiness and fulfillment to your life.